Sqrrl is a savings and investment app that is designed to help you grow into the habit of saving and attain the ultimate goal of financial fitness.

To quote their mission statement,

“Sqrrl is a platform aimed at helping young Indians save their earnings while keeping things simple. With Sqrrl, it’s not about putting away large chunks of your salary, but rather small sums with just a couple of clicks! Everyone hates to see their hard-earned money go into taxes. Along with helping you save, Sqrrl also loves to make tax savings simple and effortless for you. All this with the aim to help young Indians prosper!”

Product Offerings:

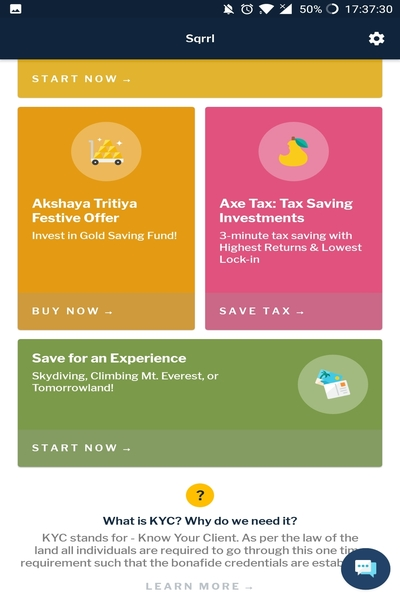

Sqrrl has a host of different product offerings, customized for different sets of users, to meet different goals. Here we’ll have a look at a few of them.

Sqrrl Away

Sqrrl Away is a feature which gives users the scope of putting away small amounts of money into a virtual savings nest. The biggest benefit with Sqrrl Away is that in comparison to a typical savings account which gives you a menial return of 3.5%, Sqrrl Away will generate approx. 6-7%, by investing in only those mutual funds that have performed better. Another thing to cheer about is that you can start with as low as Rs 100 and can set up weekly payments and even top up your savings. Finally, with Sqrrl Away you can withdraw your money 24/7 – 500 – 50,000 instantly or 100% of the amount on the next business day morning. It doesn’t have a lock-in period either.

Search & Invest

Search and Invest is specifically for the more educated users, who have good knowledge of investing and markets, in general. It comes with an option to invest in over 2800 mutual funds and schemes, and is an ideal feature for anyone wanting to invest in the funds, only of their choice. Almost every information that an investor might require before zeroing in upon a particular fund, such as the fund rating, risk, fund manager, 1-3-5 year returns, fund type, investment plan, and a lot more, has been made available on the app, through this feature.

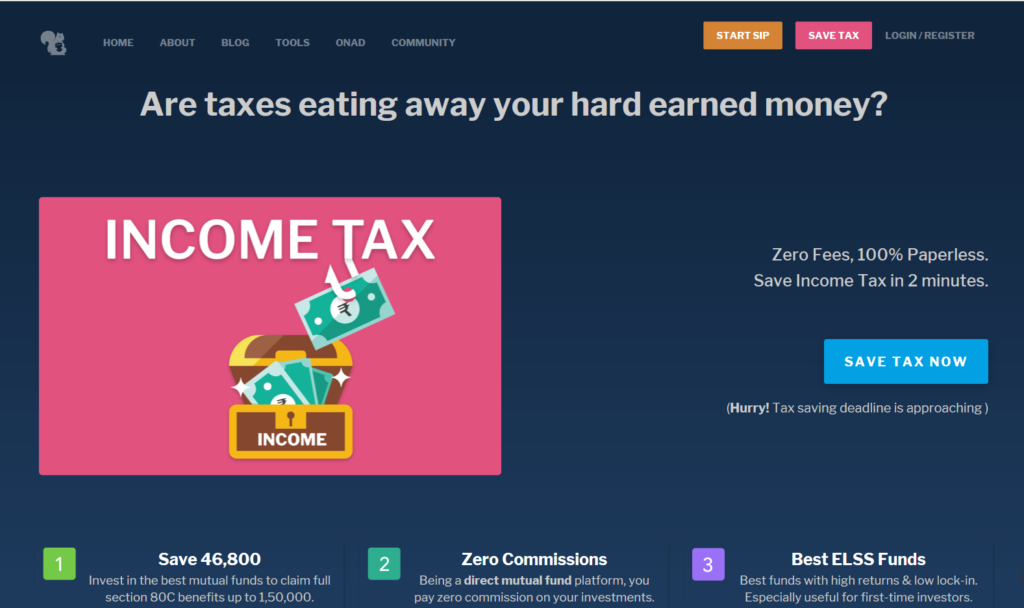

Axe Tax

If saving income tax is on your mind, then Axe Tax is for you. Almost everyone knows that the government allows you 1,50,000 of tax rebate and Axe Tax can help you in realising this entire amount, or in simple words, claiming the full rebate. Axe Tax will guide you to the total amount you need to invest to claim the full Income tax benefits.

And it’s not just these. The company also offers a lot of other investment options in gold funds, SIP, lump sum, etc.

How to get started?

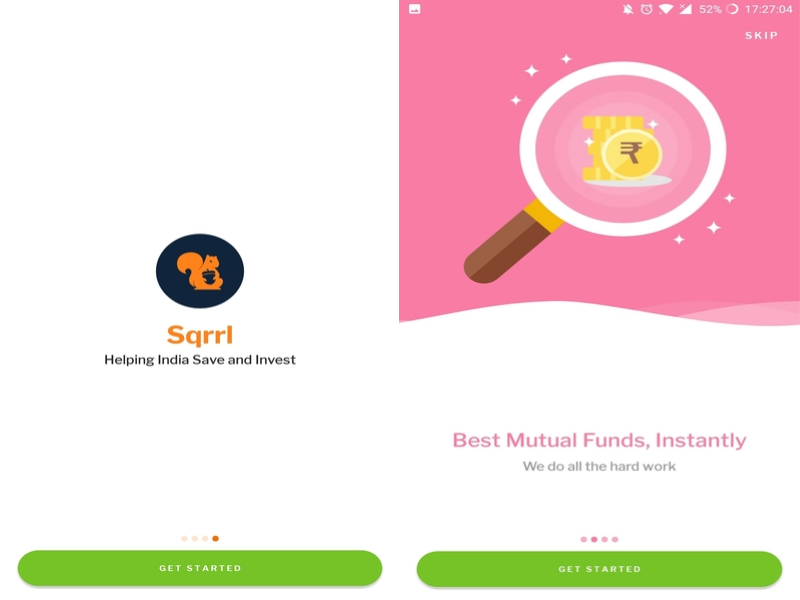

With a very clean, vibrant, and user-friendly interface, Sqrrl has indeed managed to keep things simple. Let’s have a look at the step-by-step procedure to know how they do it.

.

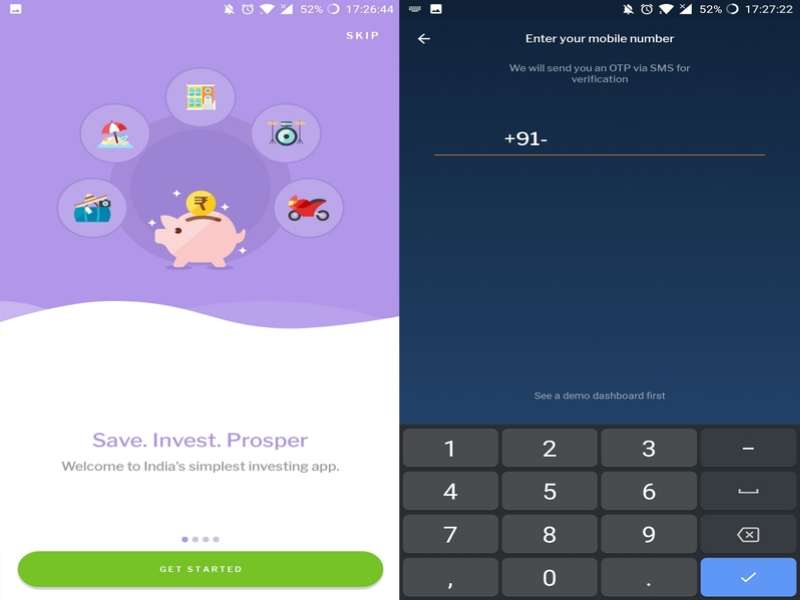

- Download the Sqrrl app from the Google Play Store/iOS store. Once installed, click open the app and you’ll be greeted with the welcome screen.

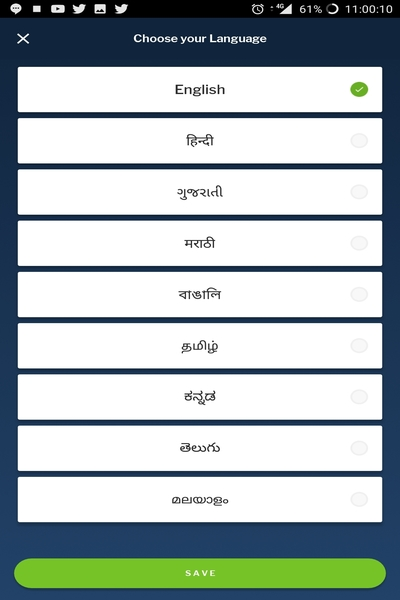

- Sqrrl was the very 1st Mutual Funds app, in India, to have the vernacular capability, and it currently supports 9 languages (English + 8). In the second step, you’ll be presented with these nine languages and you can proceed ahead, after selecting your preferred language.

- Click on the get started tab at the bottom (you can also explore what all the app is capable of) and enter your phone number to signup.

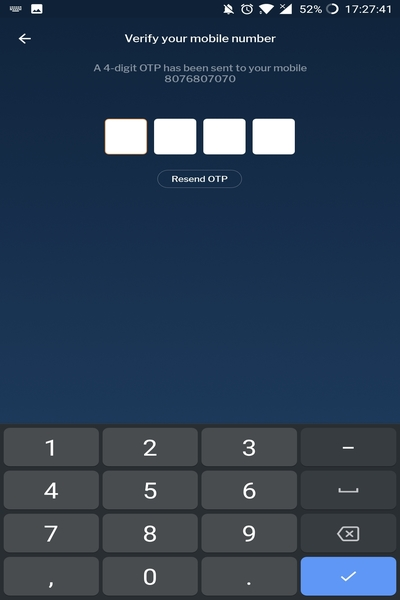

- Next, you’ll receive an OTP and once you feed that in, you’ll be redirected to your profile building screen.

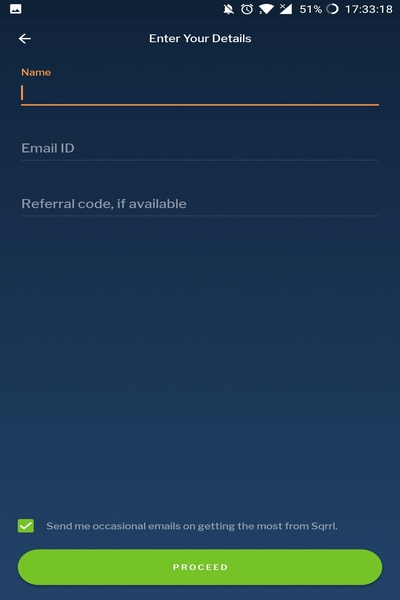

- Next you’ll be required to enter your name and email id (and a referral code, if you have one) after which you’ll be taken to your bank verification screen..

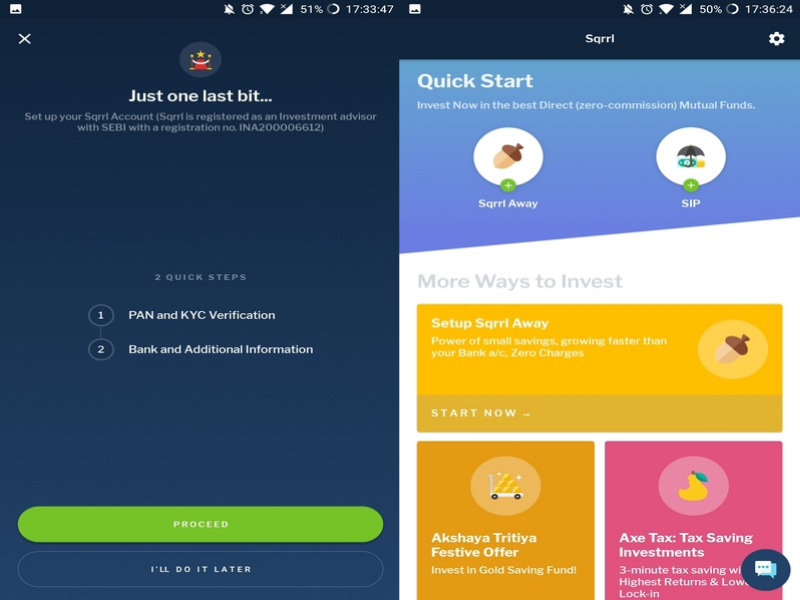

- Here, the app will ask you to set up your account through 2 very quick but important steps – PAN & KYC verification and Bank & Additional Information. Here you’ll also be able to see the other options via which you can begin your investing journey, along with in-depth information on what the respective options are.

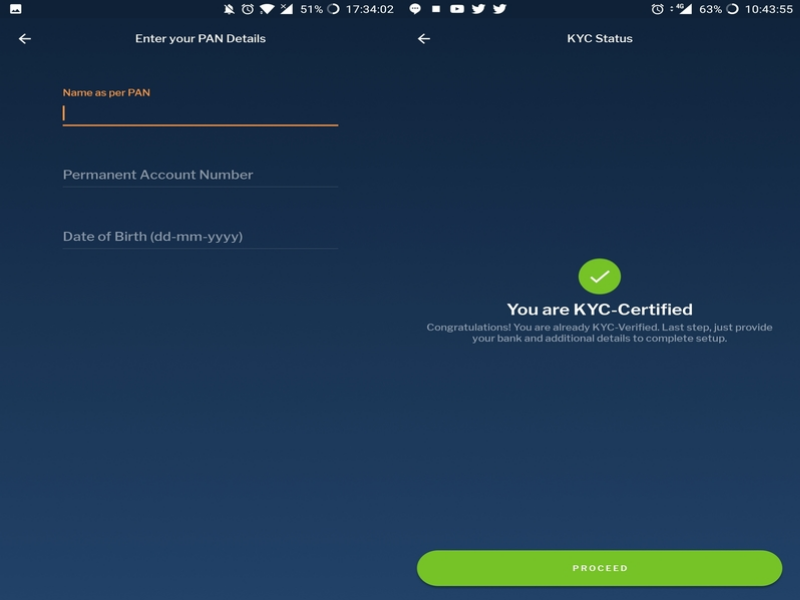

- You’ll be asked to enter your PAN details in the next screen – your name, PAN number, and date of birth. And then, confirm your details. This will make you a KYC-Certified user.

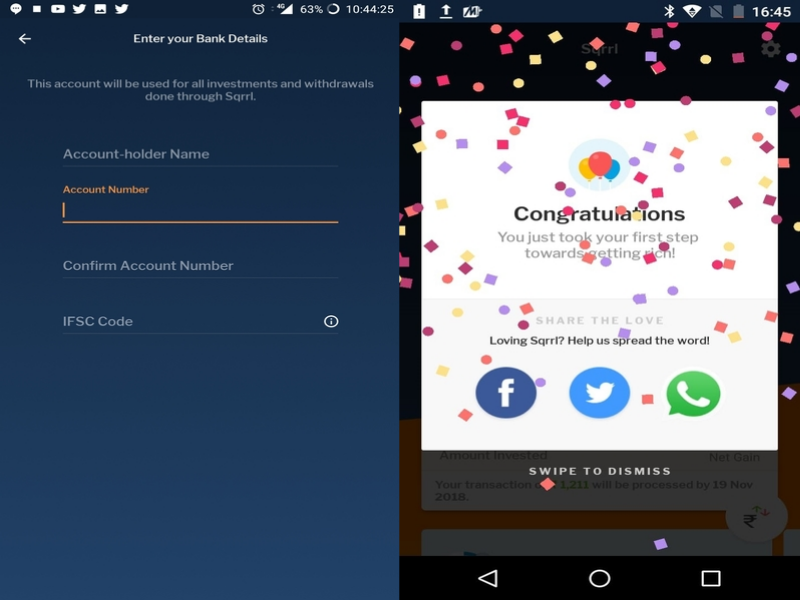

- The final screen will ask you to enter your bank details wherein you’ll be asked to enter the account holder’s name, account number, confirm your account number and IFSC Code. Once done, verify your details in the next screen and hit proceed.

- Congratulations! You’re all set to carry out your first transaction, once you complete the other formalities to get you started.

- The firm is regulated by SEBI and comes under the purview of AMFI with 128-bit encryption and bank grade security. Backed by a highly credible team of experts, with a collective experience of over 60 years in the mutual fund’s industry, Sqrrl is one app you should look at, for all your investing needs.

Also, We recommend you to have a look at this video to get an understanding of Section 80C for saving taxes.